State of West Bengal v. Jai Hind Pvt. Ltd. 2026 INSC 132 - Review Jurisdiction - Executive Authorities

West Bengal Estates Acquisition Act, 1953 –The WBEA Act does not confer any power of substantive review upon the Revenue Officer, either expressly or by necessary implication (Para 91) The power of review is essentially a core judicial function, and conferring such a power upon executive authorities, absent an express legislative mandate, would blur the constitutionally mandated demarcation between the executive and the judiciary, permit the executive authorities to sit in judgment over their own decisions, and erode the rule of law by diluting finality (Para 57)

Code of Civil Procedure 1908 - Section 114 - Order XLVII Rule 1 - Only on the following grounds, a review would lie: i. Discovery of new and important matter or evidence: A review can be sought under this ground by an aggrieved litigant on the discovery of a certain new and important matter or evidence, which, after exercise of due diligence, was not within his knowledge or could not be produced by him at the time when the decree was passed. A review of a judgment is a drastic step, and a reluctant resort to it is proper only where a glaring omission or patent mistake or a grave error has crept in earlier by judicial fallibility. A mere repetition, through different counsel, of old and overruled arguments, a second trip over ineffectually covered ground or minor mistakes of inconsequential import, are obviously insufficient or ii. Mistake or error apparent on the face of the record -The error under this ground must be self-evident and should not require an exhaustive examination or argument to establish it, or iii. Any other sufficient reason: For instance, inter alia, where the Court omits to notice or consider relevant statutory provisions ; an order arising out of a lack of jurisdiction -Scope of review: The purpose of a review is to rectify manifest or exceptional wrongs. It is not for reappreciating facts or seeking a different conclusion. Thus, a review could not be an appeal in disguise by reappreciating the evidence and grounds which have already traversed or come to a conclusion. (Para 60-80)

Limitation Act, 1963 - Article 124 - While it is true that Constitutional Courts are not strictly bound by limitation in exercising their jurisdiction, the position is markedly different in respect of the review jurisdiction of Civil Courts governed by the CPC. Under Article 124 of the Schedule of the Limitation Act, 1963, an application for review is required to be filed within a period of thirty days from the date of the decree or order sought to be reviewed, subject only to extension upon sufficient cause being shown. (Para 83)

Decree- A decree passed by a Court without jurisdiction is a nullity, and that its invalidity could be set up whenever and wherever it is sought to be enforced or relied upon, even at the stage of execution and even in collateral proceedings. (Para 88)

Constitution of India - Separation of power and independence of the judiciary have been considered integral parts of the basic structure of our Constitution -eparation of powers provides the guarantee for the independence of the judiciary and also acts as a safeguard against arbitrariness, upholding democratic values and the rule of law. (Para 36-46)

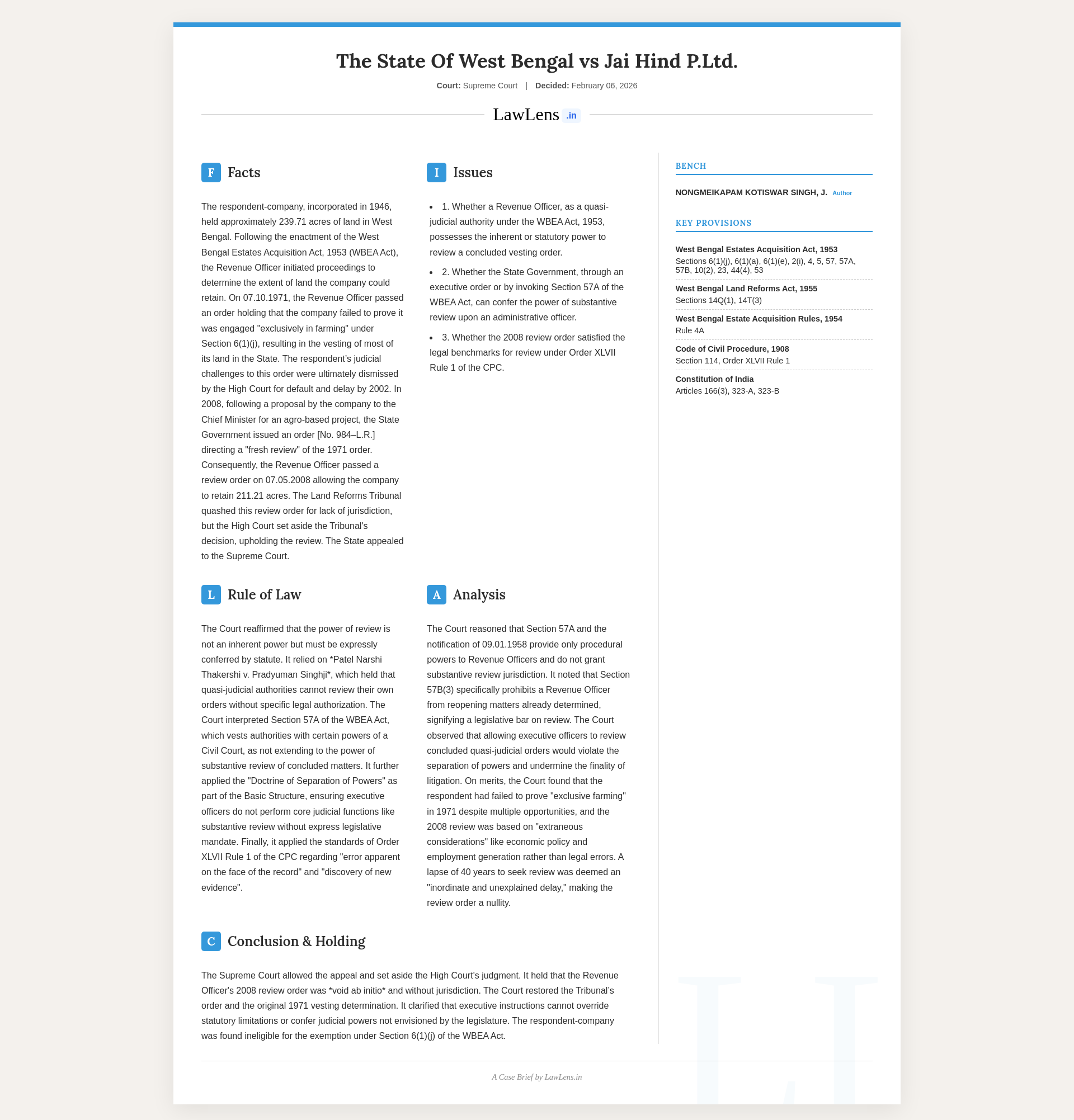

Case Info

Case name: State of West Bengal & Ors. v. Jai Hind Pvt. Ltd.Neutral citation: 2026 INSC 132

Coram: M. M. Sundresh, J. and Nongmeikapam Kotiswar Singh, J.

Judgment date: 06 February 2026 (pronounced at New Delhi)

Key caselaws and citations referred:

Patel Narshi Thakershi v. Pradyuman Singhji, (1971) 3 SCC 844Kalabharati Advertising v. Hemant Vimalnath Narichania, (2010) 9 SCC 437Patel Chunibhai Dajibhai v. Narayanrao Khanderao Jambekar, AIR 1965 SC 1457Major Chandra Bhan Singh v. Latafat Ullah Khan, (1979) 1 SCC 321State of Orissa v. Commissioner of Land Records & Settlement, (1998) 7 SCC 162Harbhajan Singh v. Karam Singh, AIR 1966 SC 641Kuntesh Gupta (Dr.) v. Hindu Kanya Mahavidyalaya, (1987) 4 SCC 525Kiran Singh v. Chaman Paswan, (1954) 1 SCC 710Bahrein Petroleum Co. Ltd. v. P.J. Pappu, 1965 SCC OnLine SC 145Assistant Custodian, E.P. v. Brij Kishore Agarwala, (1975) 1 SCC 21Maharishi Dayanand University v. Surjeet Kaur, (2010) 11 SCC 159M/s Motilal Padampat Sugar Mills Co. Ltd. v. State of U.P., (1979) 2 SCC 409Akhil Bhartvarshiya Marwari Agarwal Jatiya Kosh v. Brijlal Tibrewal, (2019) 2 SCC 684Bharat Amratlal Kothari v. Dosukhan Samadkhan Sindhi, (2010) 1 SCC 234Kesavananda Bharati v. State of Kerala, (1973) 4 SCC 225Minerva Mills Ltd. v. Union of India, (1980) 3 SCC 625I.R. Coelho v. State of T.N., (2007) 2 SCC 1S.P. Sampath Kumar v. Union of India, (1987) 1 SCC 124R.K. Jain v. Union of India, (1993) 4 SCC 119L. Chandra Kumar v. Union of India, (1997) 3 SCC 261Union of India v. Madras Bar Assn., (2010) 11 SCC 1Madras Bar Assn. v. Union of India, (2015) 8 SCC 583M/s Northern India Caterers Ltd. v. Lt. Governor of Delhi, (1980) 2 SCC 167Sow Chandra Kante v. Sk. Habib, (1975) 1 SCC 674Thungabhadra Industries Ltd. v. Govt. of A.P., 1963 SCC OnLine SC 94State (NCT of Delhi) v. K.L. Rathi Steels Ltd., (2024) 7 SCC 315Girdhari Lal Gupta v. D.H. Mehta, (1971) 3 SCC 189Budhia Swain v. Gopinath Deb, (1999) 4 SCC 396Narmada Bachao Andolan v. State of M.P., AIR 2011 SC 3199R. Chitralekha v. State of Mysore, AIR 1964 SC 1823Hira Lal Patni v. Kali Nath, 1961 SCC OnLine SC 42Balvant N. Viswamitra v. Yadav Sadashiv Mule, (2004) 8 SCC 706

High Court decisions discussed:Satyanarayan Banerjee v. Charge Officer & A.S.O. Birbhum, 1974 SCC OnLine Cal 1Ramaprasanna Roy v. State of West Bengal, 1987 SCC OnLine Cal 228

Statutes / laws referred:

West Bengal Estates Acquisition Act, 1953 – especially Sections 2(i), 4, 5, 6(1)(a), 6(1)(d), 6(1)(e), 6(1)(j), 10(2), 16, 23, 39, 44, 53, 57, 57A, 57BWest Bengal Estates Acquisition Rules, 1954 – Rule 4A, Form ‘B’West Bengal Land Reforms Act, 1955 – particularly Sections 14Q(1), 14T(3), 14T(3a) (by analogy, via Cal HC precedent)Bengal Co‑operative Societies Act, 1940Code of Civil Procedure, 1908 – Section 114, Order XLVII Rule 1Limitation Act, 1963 – Article 124 (Schedule)Constitution of India – Articles 166(3), 323‑A, 323‑B, and basic‑structure doctrines of separation of powers and independence of judiciaryRules of Business of the Government of West Bengal – Rule 19

Brief three‑sentence summary:

The Supreme Court held that a Revenue Officer under the West Bengal Estates Acquisition Act, 1953 has no statutory power of substantive review, so the 2008 order “reviewing” and overturning the 1971 vesting order in favour of Jai Hind Pvt. Ltd. was without jurisdiction and void ab initio. It further found that even on the merits no ground for review under Order XLVII Rule 1 CPC was made out, since the company had never proved that it was “engaged exclusively in farming” as on 01.01.1952 to qualify under Section 6(1)(j), and the attempt to reopen the matter four decades later rested only on policy/economic considerations and belated documents. Accordingly, the Court allowed the State’s appeal, restored the Tribunal’s order quashing the 2008 review, and directed that the original vesting order of 07.10.1971 continue to operate.