Deputy Commissioner and Special Land Acquisition Officer v. S.V. Global Mill Limited 2026 INSC 138 - S.24 RFCTLARR - Land Acquisition

Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013 - Section 24 - Applicability - Awards Passed After Commencement Of Act

Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013 (RFCTLARR Act)- Section 24 - (i) Section 24(1)(a) of the 2013 Act is applicable to all those cases where awards are passed after the commencement of the 2013 Act. (ii) For passing the award under Section 24(1)(a), the provisions of the 2013 Act alone will have to be followed, except for the rehabilitation and resettlement entitlements. (Para 97)

RFCTLARR Act - Section 74 ; Land Acquisition Act 1894 - Section 54 The first appeals before the High Courts should be treated as ones under Section 74 of the 2013 Act and not under Section 54 of the 1894 Act. (Para 97)

RFCTLARR Act - Section 74; Limitation Act 1963 - Section 5 - Section 74 of the 2013 Act does not bar the application of Section 5 of the 1963 Act. (Para 97)

Limitation Act 1963 - Section 29(2)- The compliance of Section 29(2) is mandatory, with the exception arising only by way of an express exclusion. (Para 62) Express exclusion is the general rule and implied exclusion is only an exception that comes into play depending on the nature and scheme of the concerned legislation. Therefore, the onus lies heavily on the party claiming an implied exclusion to show the same.(Para 90) Mere incorporation of a specific period of limitation under the special or local law does not amount to express exclusion of the 1963 Act. Rather, it must indicate that Sections 4 to 24 of the 1963 Act are excluded. As a matter of rule, the said words must be present in the special or local law. (Para 59)

Interpretation of Statutes -Interpretation of a word or a provision must be made contextually with respect to each statute and, therefore, importing any understanding to a different statute would be fraught with dangerous consequences. (Para 87) any interpretation having the impact of destroying a right in seeking an adjudication on merits, should be eschewed unless it appears so on the very face of it. Even when two interpretations are possible, the one that facilitates the filing of an appeal must be approved. (Para 79) When the Legislature introduces a provision, there can be no interpretation in ignorance of it. Such an ignorant interpretation would also be dangerous, as it would amount to striking down the very provision itself even without a challenge. (Para 78)

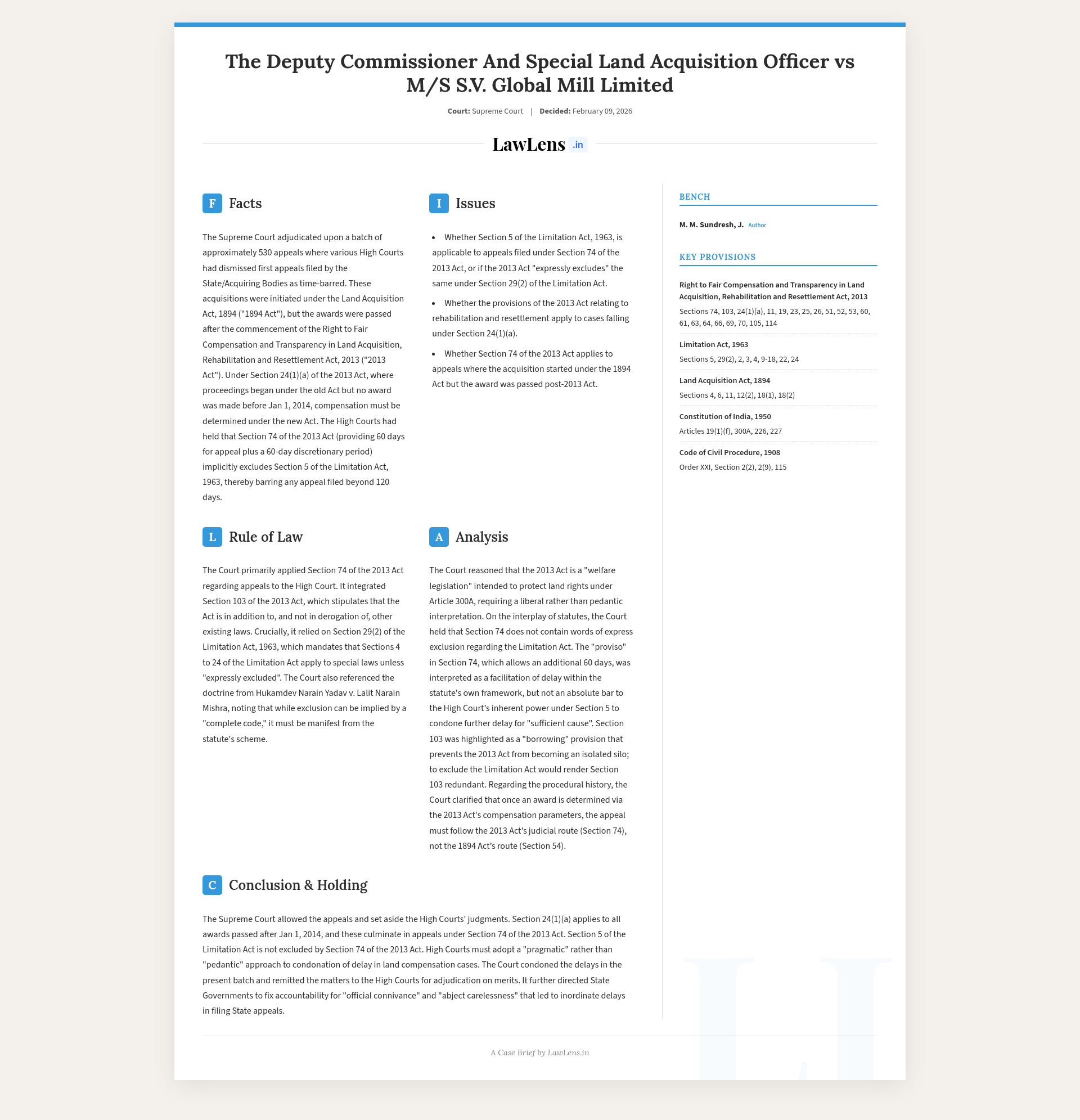

Case Info

Basic Case Details

Case name: The Deputy Commissioner and Special Land Acquisition Officer v. M/s S.V. Global Mill Limited & Connected Matters

Neutral citation: 2026 INSC 138

Coram:

- Hon’ble Mr. Justice M. M. Sundresh

- Hon’ble Mr. Justice Satish Chandra Sharma

Judgment date: 9 February 2026 (NEW DELHI)

Key Statutes / Laws Referred

- Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013

- Particularly: Sections 11, 19, 23, 24, 25, 26, 51–53, 60–61, 63–64, 69–70, 74, 103, 105, 114.

- Land Acquisition Act, 1894

- Especially Section 11, Section 54, and the transition via Section 24 of the 2013 Act.

- Limitation Act, 1963

- Especially Sections 2(j), 3, 4–5, 9–24, 25, 29(2).

- Constitution of India

- Article 19(1)(f) (repealed fundamental right to property, discussed historically),

- Article 300A (constitutional right not to be deprived of property save by authority of law),

- Articles 226 and 227 (in the context of jurisdiction bar under Section 63 of the 2013 Act).

- General Clauses Act, 1897

- Section 6 (savings on repeal, via Section 114(2) of the 2013 Act).

- Other Codes/Acts incidentally referred for characterisation of courts/tribunals:

- Code of Civil Procedure, 1908

- Code of Criminal Procedure (1898 and 1973)

- Indian Penal Code, 1860

Important Case Law Cited (with citations)

Only a selection of the more central authorities is set out here:

- Indore Development Authority v. Manoharlal, (2020) 8 SCC 129– On Section 24 of the 2013 Act and when proceedings continue under the 1894 Act vs shift to the 2013 Act.

- Haryana State Industrial and Infrastructure Development Corporation Ltd. v. Deepak Agarwal, (2023) 6 SCC 512– On what “initiation” of land acquisition means under Section 24(1) and how 2013 Act provisions on compensation apply to acquisitions initiated under the 1894 Act but not culminating in an award before 1‑1‑2014.

- Union of India v. Prabhakaran Vijaya Kumar, (2008) 9 SCC 527– Principle that beneficial/welfare statutes should receive a liberal interpretation.

- Delhi Development Authority v. Virender Lal Bahri, (2020) 15 SCC 328– 2013 Act as beneficial legislation; interpretation of Section 24 in light of the Preamble.

- Sakuru v. Tanaji, (1985) 3 SCC 590– Limitation Act applies only to “courts”, not to quasi‑judicial or executive authorities; Section 5 cannot be invoked before such authorities unless expressly provided.

- Officer on Special Duty (Land Acquisition) v. Shah Manilal Chandulal, (1996) 9 SCC 414– Collector under Section 18 of the 1894 Act is not a “court” and cannot use Section 5 Limitation Act to condone delay in seeking reference.

- M.P. Steel Corporation v. Commissioner of Central Excise, (2015) 7 SCC 58– Limitation Act applies to courts, not tribunals; scope of Section 29(2) explained; conflict noted with Mukri Gopalan.

- KSL and Industries Ltd. v. Arihant Threads Ltd., (2015) 1 SCC 166– Interpretation of “in addition to and not in derogation of” in a saving clause.

- Pioneer Urban Land and Infrastructure Ltd. v. Union of India, (2019) 8 SCC 416– Effect of “in addition to and not in derogation of” (there, under RERA); use of multiple remedial statutes together.

- Sheo Raj Singh v. Union of India, (2023) 10 SCC 531– Liberal approach to condonation when State is delayed; reference to hidden “forces” and public interest.

- Hukumdev Narain Yadav v. Lalit Narain Mishra, (1974) 2 SCC 133– On when special laws “expressly exclude” Sections 4–24 of the Limitation Act, and the doctrine of implied exclusion.

- Mangu Ram v. Municipal Corporation of Delhi, (1976) 1 SCC 392– Section 29(2) can make Section 5 applicable to criminal appeals; distinguished from Kaushalya Rani.

- New India Assurance Co. Ltd. v. Hilli Multi Purpose Cold Storage (P) Ltd., (2020) 5 SCC 757– Strict timelines under Consumer Protection Act; discussed but ultimately treated as not binding on present issue because it did not analyse Section 29(2) or a saving clause like Section 103.

- D.N. Banerji v. P.R. Mukherjee, AIR 1953 SC 58; M/s MSCO (P) Ltd. v. Union of India, (1985) 1 SCC 51; State of Gujarat v. Mansukhbhai Kanjibhai Shah, (2020) 20 SCC 360; Gujarat Urja Vikas Nigam Ltd. v. Amit Gupta, (2021) 7 SCC 209; C. Bright v. District Collector, (2021) 2 SCC 392– All cited mainly on principles of statutory interpretation: contextual reading, limits of pari materia, and how to read provisos and mandatory language.

- Sarva Shramik Sanghatana v. State of Maharashtra, (2008) 1 SCC 494– On precedential value: a case is authority only for what it actually decides.

(There are several more authorities cited for specific points, but these are the main ones shaping the reasoning.)

Three‑Sentence Brief Summary

The Supreme Court holds that where land acquisition proceedings began under the Land Acquisition Act, 1894 but the award was passed after the 2013 Act came into force, Section 24(1)(a) requires that the entire compensation determination (but not rehabilitation and resettlement) be governed by the 2013 Act, and that appeals from the Authority’s award lie under Section 74 of the 2013 Act, not Section 54 of the 1894 Act. It further decides that Section 74 does not “expressly exclude” Sections 4 to 24 of the Limitation Act, 1963 and, read with Section 29(2) of the Limitation Act and Section 103 of the 2013 Act (“in addition to and not in derogation of”), the High Court can apply Section 5 to condone delay in filing such first appeals, adopting a liberal, justice‑oriented approach in this beneficial land‑acquisition regime. Consequently, the Court sets aside numerous High Court orders that had dismissed appeals as time-barred, condones the delays itself, remits the matters for decision on merits, and directs State authorities to put systems in place to prevent such systemic delays and possible collusion in future.