State Bank of India v. Union of India 2026 INSC 153 IBC - Telecom Service Providers

Insolvency and Bankruptcy Code, 2016-IBC includes only those tangible or intangible assets within the insolvency framework over which the Corporate Debtor has ownership rights, including all rights and interests therein as recorded in the Balance Sheet (Para 62)- Spectrum allocated to telecom service providers (TSPs) and shown in their books of account as an “asset” cannot be subjected to proceedings under IBC. (Para 69) Telegraph Act, Wireless Telegraphy Act and TRAI Act forms a complete and exhaustive code for all matters relating to telecom sector (Para 66) The statutory regime under IBC cannot be permitted to make inroads into telecom sector and re-write and restructure the rights and liabilities arising out of administration, usage, and transfers of spectrum which operate under exclusive legal regime concerning telecommunications. (Para 67)

Interpretation of Statutes - Conflicts between a general statute and a special statute, or between two statutes each possessing a special character - Principles: (I) Where two enactments are attracted to the same factual matrix, the initial inquiry must be directed towards determining whether either statute is general or special in relation to the subject-matter in issue. This determination is not made in the abstract, but by examining the dominant subject-matter of the statute, viewed through the prism of its legislative intent. An enactment may, depending on the context, operate as a general law for certain purposes and as a special law for others. The optimal outcome is achieved where each statute is allowed to function within its designated sphere, without trenching upon the field occupied by the other. Bearing this in mind, the provisions of both enactments must be scrutinised to assess whether they can be construed in a manner that permits harmonious construction. (II) Where it is evident that one enactment is intended to function as a special law governing a defined subject, while the other is a general law operating in a broader or overlapping domain, the established principle embodied in the maxim generalia specialibus non derogant applies. In such circumstances, the general provision must give way to the special provision. (III) In an eventuality where the contestation is between two special enactments, both having non-obstante clauses, the general rule is that later enactment must prevail over the earlier one. (IV) However, this is not an absolute rule. In the event of a conflict between two special acts, the dominant purpose of both statutes would have to be analyzed to ascertain which one should prevail over the other. The primary effort of the interpreter must be to harmonise, not excise. Hence, where both the enactments have the non obstante clause then in that case, the proper perspective would be that one has to see the subject and the dominant purpose for which the special enactment was made and in case the dominant purpose is covered by that contingencies, then notwithstanding that the Act might have come at a later point of time still the intention can be ascertained by looking to the objects and reasons. (Para 64)

Spectrum - Spectrum is vested and secured in the custody of the Central Government not as a property but as the exclusive privilege of establishing, maintaining and operating telecommunication systems, and for granting licences. (Para 18)

Constitution of India - Article 14 - While State largesse must be distributed in conformity with Article 14, ensuring fairness, transparency and adequate compensation to the public, it does not translate into transfer of ownership or creation of proprietary rights in favour of the licensee. . Spectrum access is in the nature of State largesse The grant of a telecom licence, including the right to use spectrum, does not effect a transfer of ownership or proprietary interest. What is conferred is a limited, conditional and revocable privilege to use spectrum for specified purposes and for a defined duration. (Para 33)

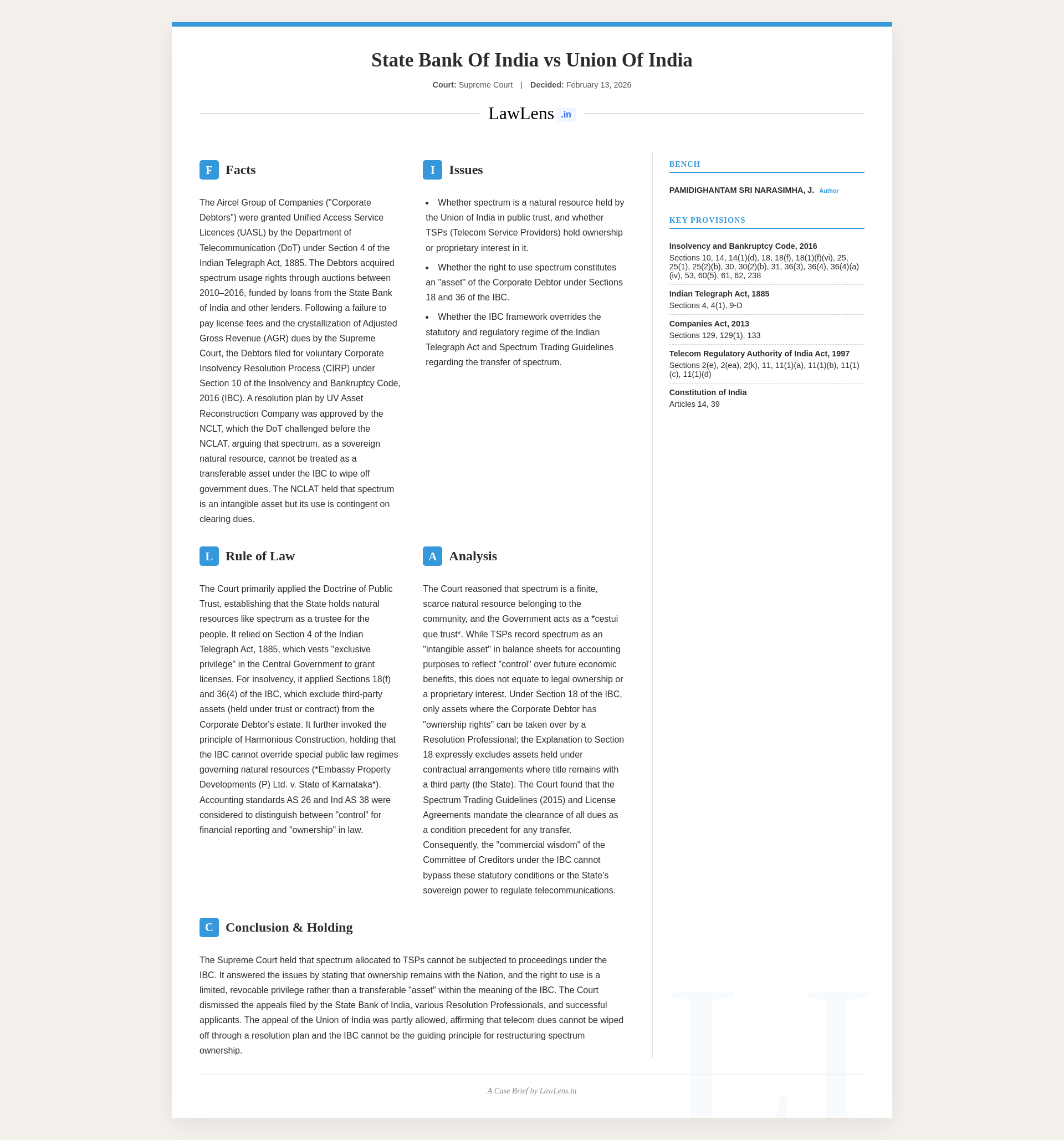

Case Info

Case name: State Bank of India v. Union of India & Ors. (with connected Civil Appeals)Neutral citation: 2026 INSC 153

Coram:Justice Pamidighantam Sri NarasimhaJustice Atul S. Chandurkar

Judgment date: 13 February 2026 (Supreme Court of India, Civil Appellate Jurisdiction)

Caselaws and citations referred:

- Union of India v. Association of Unified Telecom Service Providers of India, (2011) 10 SCC 543 (AUSPI I)

- Union of India v. Association of Unified Telecom Service Providers of India, (2020) 3 SCC 525 (AUSPI II)

- Union of India v. Association of Unified Telecom Service Providers of India, (2020) 9 SCC 748

- In Re: Mandar Deshpande, 2020 SCC OnLine SC 758

- Centre for Public Interest Litigation v. Union of India, (2012) 3 SCC 1 (2G / CPIL case)

- Natural Resources Allocation, In Re, Special Reference No. 1 of 2012, (2012) 10 SCC 1

- M.C. Mehta v. Kamal Nath, (1997) 1 SCC 388

- State of Orissa v. Harinarayan Jaiswal, (1972) 2 SCC 36

- Har Shankar v. Excise & Taxation Commissioner, (1975) 1 SCC 737

- Panna Lal v. State of Rajasthan, (1975) 2 SCC 633

- State of Punjab v. Devans Modern Breweries Ltd., (2004) 11 SCC 26

- Bharti Airtel Ltd. v. Union of India, (2015) 12 SCC 1

- Swiss Ribbons (P) Ltd. v. Union of India, (2019) 4 SCC 17

- Innoventive Industries Ltd. v. ICICI Bank, (2018) 1 SCC 407

- K. Sashidhar v. Indian Overseas Bank, (2019) 12 SCC 150

- Committee of Creditors of Essar Steel India Ltd. v. Satish Kumar Gupta, (2020) 8 SCC 531

- LIC of India v. D.J. Bahadur, (1981) 1 SCC 315

- Gobind Sugar Mills Ltd. v. State of Bihar, (1999) 7 SCC 76

- State of Gujarat v. Patel Ramjibhai Danabhai, (1979) 3 SCC 347

- Commercial Tax Officer, Rajasthan v. Binani Cements Ltd., (2014) 8 SCC 319

- Vodafone Idea Cellular Ltd. v. Ajay Kumar Agarwal, (2022) 6 SCC 496

- Sarwan Singh v. Kasturi Lal, (1977) 1 SCC 750

- S. Vanitha v. Deputy Commissioner, Bengaluru Urban District, (2021) 15 SCC 730

- Bank of India v. Ketan Parekh, (2008) 8 SCC 148

- Embassy Property Developments (P) Ltd. v. State of Karnataka, (2020) 13 SCC 308

Statutes / laws referred:

- Insolvency and Bankruptcy Code, 2016 (including ss. 5(8), 5(21), 14, 18, 25, 30, 31, 36, 53, 60, 238)

- Indian Telegraph Act, 1885 (esp. s. 4, s. 9-D)

- Indian Wireless Telegraphy Act, 1933

- Telecom Regulatory Authority of India Act, 1997 (esp. s. 11)

- Companies Act, 2013 (ss. 129, 133)

- Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI)

- Constitution of India (Arts. 14, 39(b) and Directive Principles context; public trust doctrine)

- Indian Contract Act, 1872 (s. 23 – public policy)

- Transfer of Property Act, 1882 (conceptual reference re “property”)

- Sale of Goods Act, 1930 (conceptual reference)

Subordinate legislation / policy documents referred:

- New Telecom Policy, 1994

- New Telecom Policy, 1999

- National Telecom Policy, 2012

- Unified Access Service Licence (UASL) conditions

- Guidelines for Trading of Access Spectrum by Access Service Providers, 2015 (esp. Guidelines 10, 11, 12)

- Tripartite Agreements between DoT, TSPs and lenders

- TRAI recommendations on spectrum trading and sectoral regulation

Brief summary (three sentences):The Supreme Court holds that telecom spectrum is a natural resource held by the Union of India in public trust and that telecom service providers obtain only a limited, conditional right to use it, not ownership or a proprietary interest. Consequently, spectrum or spectrum-usage rights, though booked as “intangible assets” under accounting standards, do not constitute “assets” of the corporate debtor within the meaning of the Insolvency and Bankruptcy Code and cannot be brought into or restructured through CIRP or liquidation, nor can DoT’s spectrum dues be wiped out via a resolution plan. The Court therefore upholds the primacy of the telecom statutory regime (Telegraph Act, TRAI Act, spectrum trading guidelines and licence conditions) over the IBC in relation to spectrum, dismisses the appeals by SBI, the resolution applicants and resolution professionals, and allows the Union of India’s appeal in part.