Commissioner of Customs (Import) v. Welkin Foods; 2026 INSC 19 -Common Or Trade Parlance Test

You can read our notes on this judgment in our Supreme Court Daily Digests. If you are our subscriber, you should get it in our Whatsapp CaseCiter Community at about 9pm on every working day. If you are not our subscriber yet, you can register by clicking here:

Taxation Laws -The application of the common or trade parlance test while dealing with classification disputes a. The common or trade parlance test must be applied restrictively. Its function is limited to ascertaining the common or commercial meaning of a term found within a tariff heading or its defining criterion. b. The trade or common parlance test can be invoked when dealing with a classification dispute only when the following conditions are satisfied. i. The governing statute, including the relevant tariff heading, Section Notes, Chapter Notes, or HSN Explanatory Notes, does not provide any explicit definition or clear criteria for determining the meaning and scope of the tariff item in question. ii. The tariff heading does not include scientific or technical terms, or the words used in the heading are not employed in a specialised, technical context. iii. The application of the common parlance test must not contradict or run counter to the overall statutory framework and the contextual manner in which the term was used by the legislature. Thus, broadly speaking, the common or trade parlance test cannot be invoked where the statute, either explicitly or implicitly, provides definitive guidance. Explicit statutory guidance exists where the legislature provides a specific definition or a clear criterion for a term within the Act itself. Conversely, implicit guidance is found where the terms employed are scientific or technical in nature, or where the statutory context indicates that the words must be construed in a technical sense. It is only in a state of statutory silence, where the legislative intent remains unexpressed, that the tribunals or courts may resort to the common or trade parlance test. c. In the contemporary HSN-based classification regime, the common or trade parlance test cannot serve as a measure of first resort. It should only be employed after a thorough review of all relevant material confirms the absence of statutory guidance. d. When interpreting terms in a tariff item by relying on the basis of common or trade parlance, an overly simplified approach should be avoided, and the words should be understood within their legal context. Further, when a party asserts a meaning of a term based on common or trade parlance, it must present satisfactory evidence to support that claim. e. When a tariff item is general in nature and does not indicate a particular industry or trade circle, the common parlance understanding of that term is appropriate. However, when a tariff item is specific to a particular industry, the term must be understood as it is used within that specific trade circle. f. The common or trade parlance test cannot be used to override the clear mandate of the statute. Specifically: i. The test cannot be applied in a way that results in the reclassification of a good that is clearly identifiable under a particular heading according to the statute, simply because that good is marketed or called by a different name in trade or common parlance. ii. Conversely, the test cannot be used to challenge the classification of goods under a statutory heading if those goods retain the essential characteristics defined by that heading, even if they have a unique or specialised trade name. In other words, the character and nature of the product cannot be veiled behind a charade of terminology which is used to market the product or refer to it in common or commercial circles. g. To establish a separate commercial identity, it is essential to demonstrate that the good has undergone such a substantial transformation that it can no longer be characterised as a mere sub-type or category of a broader class and thus falls outside the ambit of the common or commercial understanding associated with such a class of goods.(Para 66) [SC held that the ‘mushroom growing apparatus’ is not classified as ‘machinery’ and further, that the subject goods are ‘structures’ rather than ‘parts’ of machinery.]

Case Info

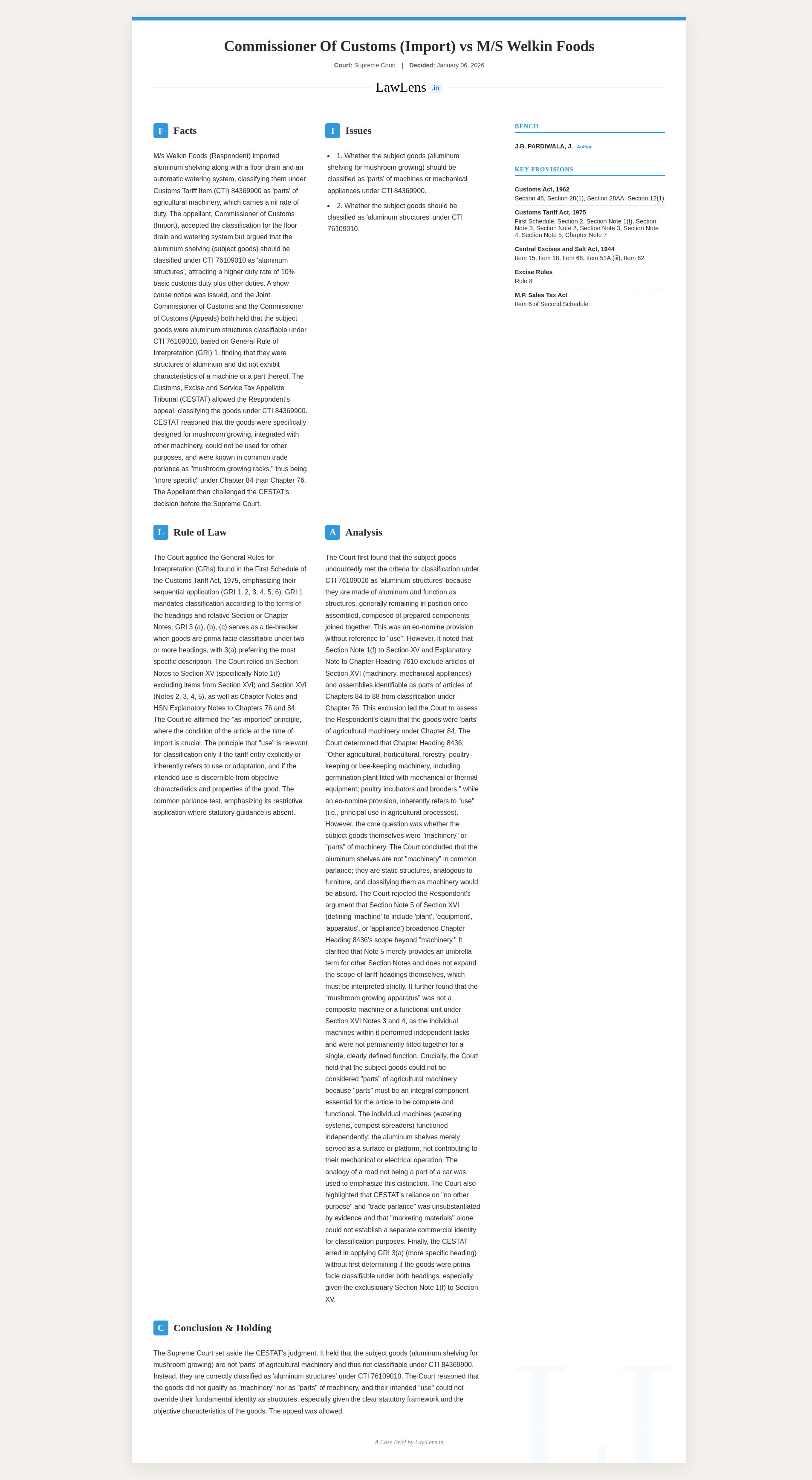

- Case name and neutral citation: Commissioner of Customs (Import) v. M/s Welkin Foods — 2026 INSC 19.

- Coram: J.B. Pardiwala, J.; R. Mahadevan, J.

- Judgment date: January 06, 2026.

- Caselaws and citations referenced:

- Dunlop India Ltd v. Union of India, (1976) 2 SCC 241.

- Indian Aluminium Cables Ltd v. Union of India, (1985) 3 SCC 284.

- Shantilal Khushaldass & Bros. Pvt. Ltd v. Assistant Collector of Customs, (1998) 9 SCC 180.

- Union of India v. V.M. Salgaoncar and Bros. Ltd, (1998) 4 SCC 263.

- Akbar Badrudin Giwani v. Collector of Customs, (1990) 2 SCC 203.

- Saraswati Sugar Mills v. CCE, Delhi-III, (2014) 15 SCC 625.

- CCEC & ST, Visakhapatnam v. Jocil Ltd, (2011) 1 SCC 681.

- Collector of Customs v. Maestro Motors Ltd, (2005) 9 SCC 412.

- Commissioner of Customs v. Sony India Ltd, (2008) 13 SCC 145.

- Salora International Ltd v. CCE, (2012) 9 SCC 662.

- Commissioner of Central Excise, Nagpur v. Simplex Mills Co. Ltd, (2005) 3 SCC 51.

- Secure Meters Ltd v. Commissioner of Customs, (2015) 14 SCC 239.

- Commissioner of C.Ex., Salem v. Madhan Agro Industries (India) Pvt Ltd, 2024 SCC OnLine SC 3775.

- Camlin Ltd v. CCE, Mumbai (cited within Madhan Agro).

- Indo International Industries v. CST, (1981) 2 SCC 528.

- Pappu Sweets and Biscuits v. Commissioner of Trade Tax, (1998) 7 SCC 228.

- Asian Paints India Ltd v. CCE, (1988) 2 SCC 470.

- United Offset Process (P) Ltd v. Asst. Collector of Customs, 1989 Supp (1) SCC 131.

- Oswal Agro Mills Ltd v. CCE, 1993 Supp (3) SCC 716.

- Garware Nylons Ltd v. Union of India, (1996) 10 SCC 413.

- Indian Cable Co. Ltd v. CCE, (1994) 6 SCC 610 (context in Garware).

- Commissioner of C.Ex., New Delhi v. Connaught Plaza Restaurant Pvt Ltd, (2012) 13 SCC 639.

- Commissioner of Customs & C.Ex., Amritsar v. D.L. Steels, (2023) 17 SCC 358.

- Chemical & Fibres of India Ltd v. Union of India, (1997) 2 SCC 664.

- Reliance Cellulose Products Ltd v. CCE, (1997) 6 SCC 464.

- Indian Tool Manufacturers v. CCE, 1994 Supp (3) SCC 632.

- O.K. Play (India) Ltd v. CCE, (2005) 2 SCC 460.

- Commissioner of C.Ex., Delhi v. Carrier Aircon Ltd, (2006) 5 SCC 596.

- Atul Glass Industries (P) Ltd v. CCE, (1986) 3 SCC 480.

- Thermax Ltd v. CCE, Pune-1, (2022) 17 SCC 68.

- Intel Design Systems (India) Pvt Ltd v. Commissioner of Customs & C.Ex., (2008) 3 SCC 258.

- CCE, Aurangabad v. Videocon Industries Ltd, 2023 SCC OnLine SC 357.

- Commissioner of Income Tax, Madras v. Mir Mohammad Ali, 1964 SCC OnLine SC 199.

- Dharti Dredging and Infrastructure Ltd v. Commissioner of Customs & C.Ex., Guntur, (2023) 18 SCC 103.

- A. Nagraju Bros v. State of A.P., 1994 Supp (3) SCC 122.

- Statutes/laws and rules referred:

- Customs Act, 1962:

- Section 12(1) (charging section).

- Section 28(1) (short levy/recovery).

- Section 28AA (interest).

- Section 46 (Bill of Entry).

- Customs Tariff Act, 1975:

- First Schedule (tariff, GRIs, sections/chapters).

- General Rules for Interpretation (GRI 1–6).

- Section XV Notes (Base metals), Note 1(f), Note 3.

- Section XVI Notes (Machinery), Notes 2, 3, 4, 5.

- Chapter 76 heading 7610 and CTIs under it.

- Chapter 84 heading 8436 and CTIs under it (including 84369900).

- Chapter 84 Note 7.

- Harmonised System Nomenclature (HSN) Explanatory Notes:

- Heading 73.08 (applied mutatis mutandis to 76.10).

- Heading 76.10 exclusions and alignment.

- Section XVI general, incomplete/ unassembled machines, multi-function, composite machines, functional units.

- Chapter 84 headings grouped by industry fields.

- Indian Tariff Act, 1934 (historical reference).

- Import and Export Policy references in Akbar Badrudin (Appendix items; contextual).

- International references (USA/EU) to illustrate principles (not binding law).