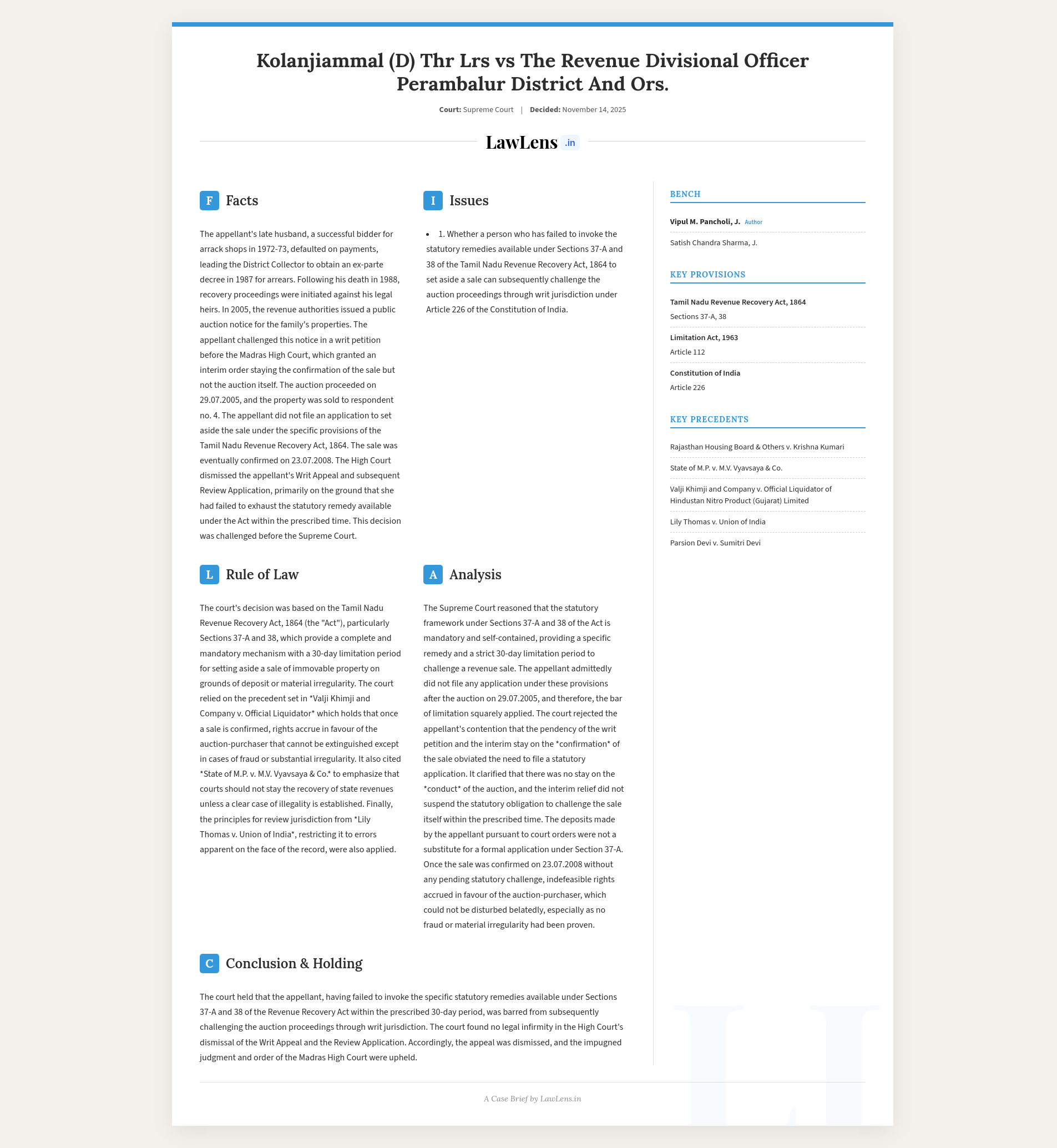

Kolanjiammal (D) Thr LRs v. Revenue Divisional Officer, Perambalur 2025 INSC 1319 - Revenue Recovery - Auction - Review Powers

Tamil Nadu Revenue Recovery Act, 1864 -Once the arrears were certified as recoverable under the provisions of the Revenue Recovery Act, the authorities were empowered to proceed with recovery through revenue processes. (Para 19)

Review Powers - A review proceeding cannot be treated as an appeal in disguise - a review can be entertained only when there is an error apparent on the face of the record. (Para 23)

Auction - once a sale is confirmed by the competent authority, rights accrue in favour of the auctionpurchaser which cannot be extinguished except in cases of proven fraud or substantial irregularity. (Para 20)

Case Info

Key Details

- Coram: Justice Satish Chandra Sharma and Justice Vipul M. Pancholi.

- Judgment date: November 14, 2025.

Caselaws and Citations

- Rajasthan Housing Board & Others v. Krishna Kumari, (2005) 13 SCC 151.

- State of M.P. v. M.V. Vyavsaya & Co., (1997) 1 SCC 156.

- Valji Khimji and Company v. Official Liquidator of Hindustan Nitro Product (Gujarat) Limited & Others, (2008) 9 SCC 299.

- Lily Thomas v. Union of India, (2000) 6 SCC 224.

- Parsion Devi & Others v. Sumitri Devi & Others, (1997) 8 SCC 715.

Statutes/Laws Referred

- Tamil Nadu Revenue Recovery Act, 1864 — Sections 37-A and 38.

- Limitation Act, 1963 — Article 112.

- Code of Civil Procedure, 1908.

LawLens - AI-Powered Legal Research for Indian Laws

Discover AI-powered legal research tools for Indian law professionals