Manjula vs Branch Manager, Oriental Insurance Company Ltd. 2025 INSC 1093 - Motor Accident Compensation

Motor Accident Compensation - Loss of consortium - Not only the wife, the children and the parents also are entitled. (Para 6) It can be safely assumed that a Coolie in the year 2010, when the subject accident occurred, would have obtained an income of Rs.7,500/-. (Para 5)

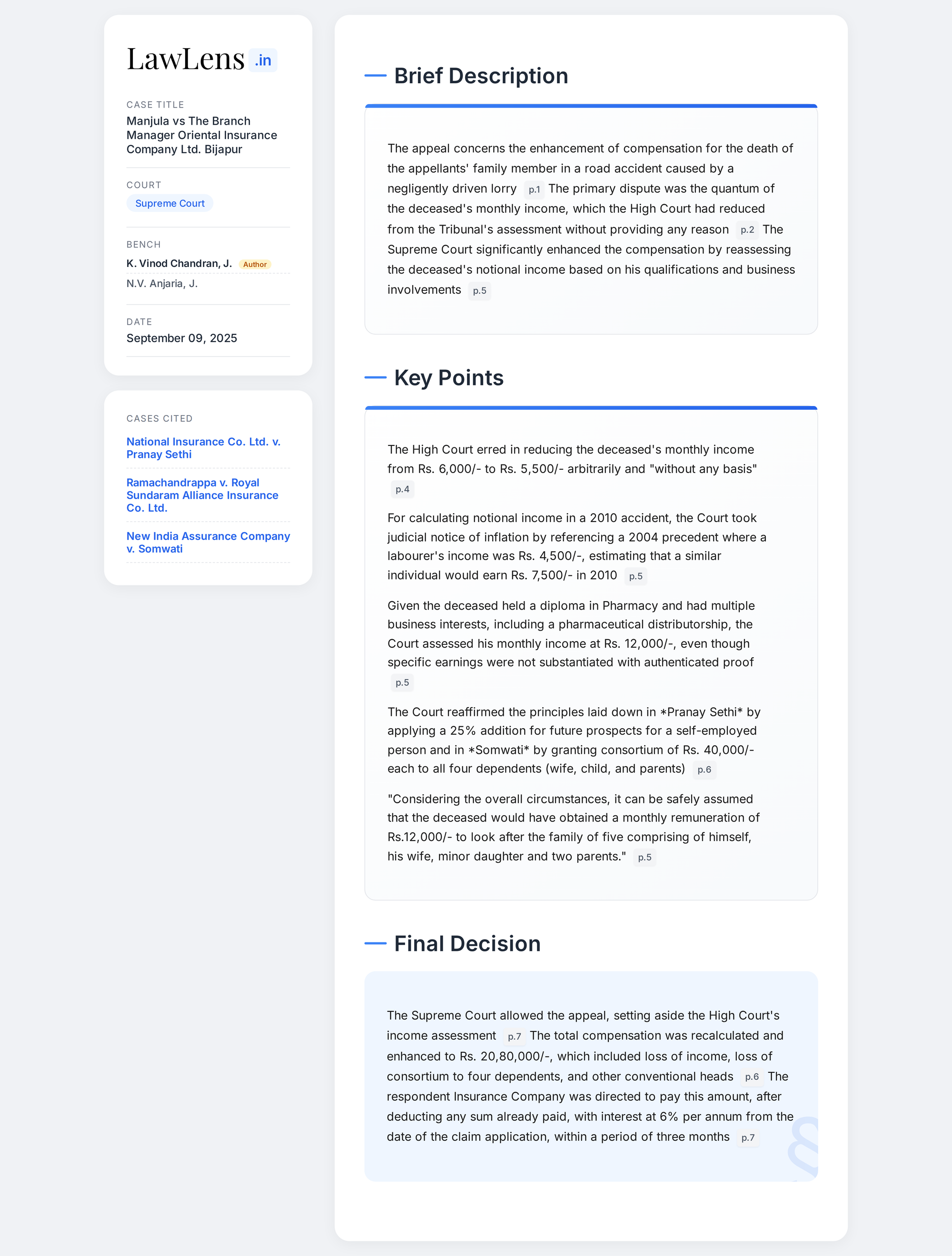

Case Info

Case Details

- Case Name: Smt. Manjula & Ors. vs. The Branch Manager, Oriental Insurance Company Ltd., Bijapur & Anr.

- Neutral Citation: 2025 INSC 1093

- Coram: K. Vinod Chandran, J. and N.V. Anjaria, J.

- Judgment Date: September 9, 2025

Caselaws and Citations Referred

- National Insurance Co. Ltd. v. Pranay Sethi

- Citation: (2017) 16 SCC 680

- Referred for: Addition to future prospects in compensation calculation.

- Ramachandrappa v. Royal Sundaram Alliance Insurance Co. Ltd.

- Citation: (2011) 13 SCC 236

- Referred for: Determination of income for compensation purposes.

- New India Assurance Company v. Somwati and Ors.

- Citation: (2020) 9 SCC 644

- Referred for: Entitlement of consortium to children and parents.

Statutes/Laws Referred

- Motor Vehicles Act, 1988 (implied, as the case concerns compensation for a motor accident)

- Principles laid down by the Supreme Court in Pranay Sethi (Constitution Bench) regarding compensation calculation

Q&A

Here are key questions and answers based on the Supreme Court judgment in Smt. Manjula & Ors. vs. The Branch Manager, Oriental Insurance Company Ltd. & Anr. (2025 INSC 1093):

1. What was the main issue before the Supreme Court in this case?

The main issue was whether the compensation awarded to the claimants for the death of the deceased in a motor accident was adequate, specifically regarding the determination of the deceased’s monthly income and the quantum of compensation.

2. What were the facts of the case?

Four friends from Bijapur died in a car accident caused by a rashly driven lorry. The deceased was the husband of the first claimant. The Tribunal fixed his monthly income at ₹6,000, but the High Court reduced it to ₹5,500 without any reasoning.

3. What did the Supreme Court decide about the deceased’s monthly income?

The Supreme Court held that, considering the deceased’s qualifications and activities, it was reasonable to fix his monthly income at ₹12,000 for compensation purposes.

4. How did the Court calculate the compensation?

The Court used the following parameters:

- Monthly income: ₹12,000

- Deduction for personal expenses: 1/4th (since there were 4 dependents)

- Multiplier: 14 (as the deceased was 43 years old)

- Future prospects: 25%

- Loss of estate: ₹15,000

- Funeral expenses: ₹15,000

- Loss of consortium: ₹40,000 each for wife, child, and parents (total 4 x ₹40,000 = ₹1,60,000)

The total compensation awarded was ₹20,80,000.

5. Which legal precedents did the Court rely on?

- National Insurance Co. Ltd. v. Pranay Sethi: For future prospects and standard compensation heads.

- Ramachandrappa v. Royal Sundaram Alliance Insurance Co. Ltd.: For determining notional income.

- New India Assurance Company v. Somwati and Ors.: For awarding consortium to all dependents.

6. What directions did the Court give regarding payment?

The insurance company was directed to pay the awarded amount (after deducting any amount already paid) with 6% interest from the date of application, within 3 months.