Poly Medicure Ltd. v. Brillio Technologies Pvt. Ltd.; 2025 INSC 1314 - Consumer Protection Act - Commercial Purpose

Consumer Protection Act 1986- Section 2- Even an incorporated company could be a consumer within the meaning of Section 2(1)(d) read with Section 2(1)(m) - The identity of the person making the purchase, or the value of the transaction, is not conclusive to determine whether the transaction or activity is for a commercial purpose. What is to be seen is the dominant intention or dominant purpose for the transaction i.e. whether it is to facilitate some kind of profit generation for the purchaser(s) and/or its/ their beneficiary. If it is found that the dominant purpose behind purchasing goods or services is for personal use and consumption of the purchaser, or is otherwise not linked to any commercial activity, the question whether such purchase is for generating a livelihood by means of self-employment need not be looked into. However, where the transaction is for a commercial purpose then it might have to be considered whether it is for generating livelihood by means of self-employment or not- Ordinarily commercial purpose is understood to include manufacturing/ industrial activity or business to business transaction between commercial entities.There is a difference between a self-employed individual and a corporation. The goods purchased by a self-employed individual for self-use for generating livelihood would fall within the explanation even if activity of that person is to generate profits for the purpose of its livelihood. But where a company purchases a software for automating its processes, the object is to maximise profits and, therefore, it would not fall within the explanation of Section 2(1)(d) of the 1986 Act. (Para 14-18) If a transaction has nexus with generation of profits, it would be for a commercial purpose. However, whether a transaction has nexus with generation of profits or not is to be determined on the facts of each case by taking into consideration, inter alia, the nature of the goods purchased or services availed and the purpose for which it is purchased or availed. If upon consideration of all relevant factors the picture that emerges is one which reflects that the object of the purchase of goods/ services is to generate or augment profit, the same would be treated as for a commercial purpose. (Para 25)

Case Info

Key Details

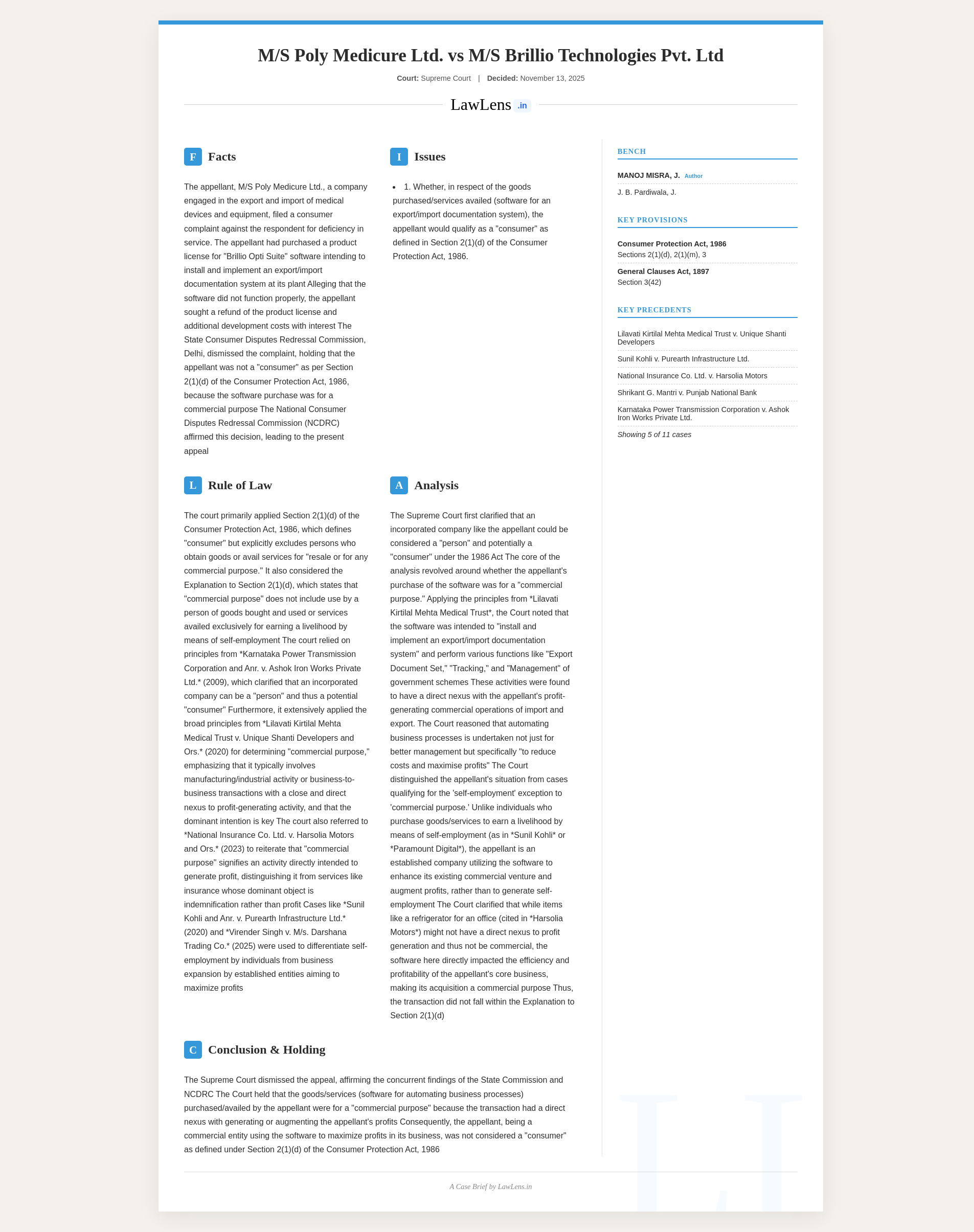

- Case name: M/S Poly Medicure Ltd. v. M/S Brillio Technologies Pvt. Ltd.

- Neutral citation: 2025 INSC 1314

- Coram: J. B. Pardiwala, Manoj Misra

- Judgment date: November 13, 2025

Caselaws and citations

- Lilavati Kirtilal Mehta Medical Trust v. Unique Shanti Developers and Ors, (2020) 2 SCC 265.

- Sunil Kohli and Anr. v. Purearth Infrastructure Ltd., (2020) 12 SCC 235.

- National Insurance Co. Ltd. v. Harsolia Motors and Ors, (2023) 8 SCC 362.

- Shrikant G. Mantri v. Punjab National Bank, (2022) 5 SCC 42.

- Karnataka Power Transmission Corporation and Anr. v. Ashok Iron Works Private Ltd., (2009) 3 SCC 240.

- Laxmi Engineering Works v. P.S.G. Industrial Institute, (1995) 3 SCC 583.

- Cheema Engineering Services v. Rajan Singh, (1997) 1 SCC 131.

- Paramount Digital Colour Lab & others v. Agfa India Pvt. Ltd. & Ors., (2018) 14 SCC 81.

- Virender Singh v. M/s. Darshana Trading Co. through its partner Sanjay Seth (Dead) & Anr., SLP (C) No. 5510 of 2020, decided on March 18, 2025.

Statutes/laws referred

- Consumer Protection Act, 1986: Section 2(1)(d) and Explanation; Section 2(1)(m).

- Companies Act, 1956.

- General Clauses Act, 1897: Section 3(42).

#SupremeCourt reiterates that an incorporated company can also be a consumer ! https://t.co/3vhV0HF3Dh pic.twitter.com/U8vv4Jz3JH

— CiteCase 🇮🇳 (@CiteCase) November 13, 2025