Shiv Steels v. State of Assam 2025 INSC 1126- Taxation- Assam General Sales Tax Act

Interpretation of Statutes - Taxation- In construing fiscal statutes and in determining the liability of a subject to tax one must have regard to the strict letter of law. If the revenue satisfies the court that the case falls strictly within the provisions of the law, the subject can be taxed. If, on the other hand, the case is not covered within the four corners of the provisions of the taxing statute, no tax can be imposed by inference or by analogy or by trying to probe into the intentions of the legislature and by considering what was the substance of the matter. (Para 14)

Assam General Sales Tax Act, 1993 - Section 19,21- In cases where no assessment has been made under any of the provisions within the time limits specified in Section 19, then, notwithstanding anything contained in that Section the assessment would be permissible within four years from the date of expiry of the limitation period with prior sanction from the Commissioner-Section 21 would apply only in cases where no assessment has been made under any of the provisions of the Act within the time limits specified in Section 19. The interpretation of the two provisions of the Act at the end of the High Court is completely incorrect. (Para 12-13)

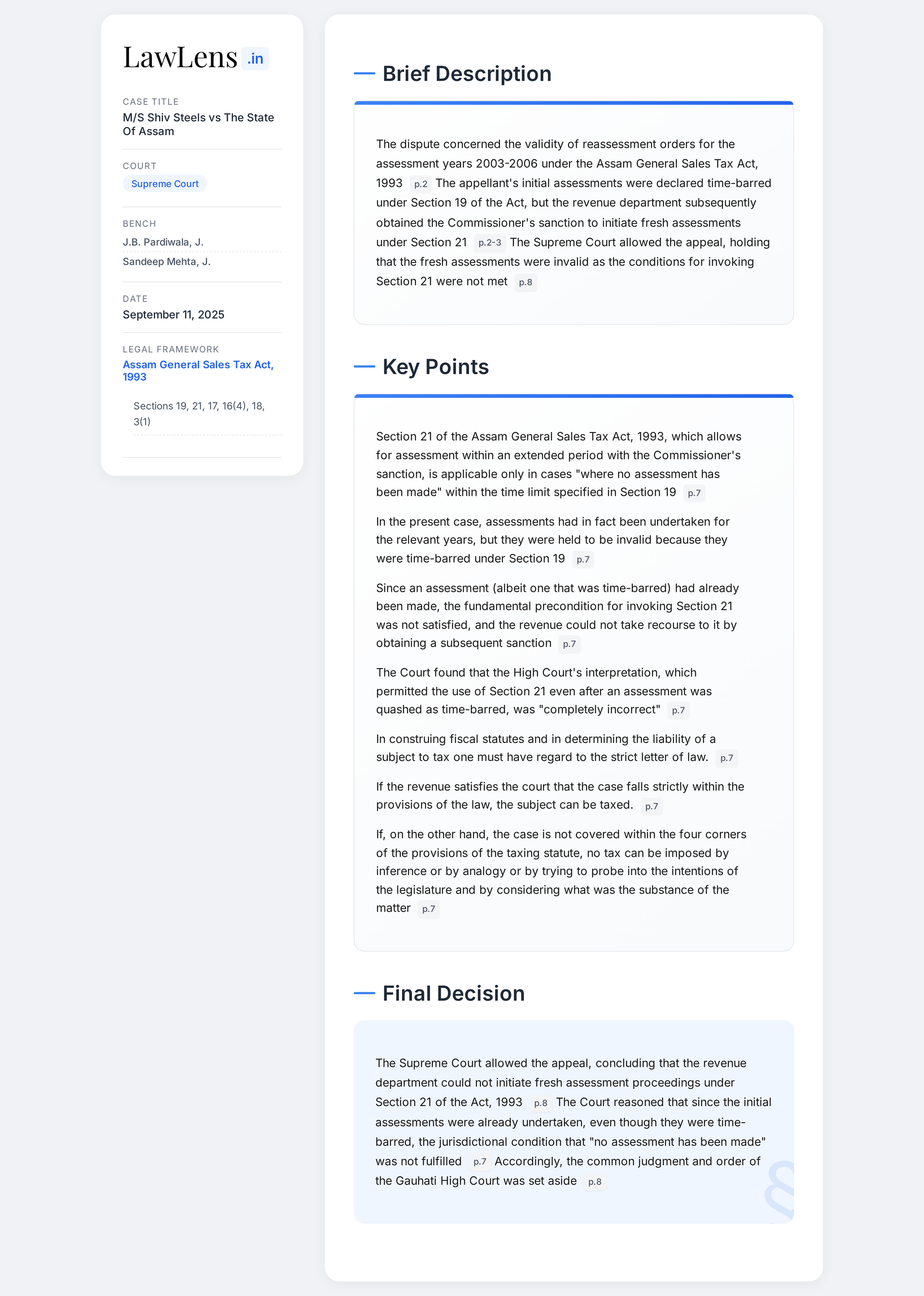

Case Info

Case Name and Neutral Citation

- Case Name: M/S. Shiv Steels v. State of Assam & Ors.

- Neutral Citation: Civil Appeal No. 4440 of 2014 (with Civil Appeal Nos. 4441 & 4442 of 2014)

Coram

- Coram:

- Hon’ble Mr. Justice J.B. Pardiwala

- Hon’ble Mr. Justice Sandeep Mehta

Judgment Date

- Date of Judgment: 11 September 2025

Statutes/Laws Referred

- Assam General Sales Tax Act, 1993

- Section 19: Time limit for completion of assessment and re-assessments

- Section 21: Assessment in certain cases

Q & A

1. What is the main subject of these appeals? The main subject of these appeals is the challenge to a common judgment and order passed by the Gauhati High Court regarding an order of reassessment made under the provisions of the Assam General Sales Tax Act, 1993. The appeals specifically concern the interpretation and application of Sections 19 and 21 of the Act, 1993, related to time limits for assessments and reassessments.

2. Who are the parties involved in these appeals? The appellant is M/S. Shiv Steels, and the respondents are The State of Assam & Ors..

3. Which assessment years are concerned in this case? The case is concerned with the assessment years 2003-2004, 2004-2005, and 2005-2006.

4. What was the appellant's primary argument regarding the assessments? The appellant argued that the assessments undertaken for all the concerned years were time-barred according to the time limit prescribed under Section 19 of the Act, 1993. Initially, the authority concerned had declared the assessments for these years to be time-barred.

5. How did the department attempt to validate the fresh assessment after it was initially deemed time-barred?The department later obtained the sanction of the Commissioner and invoked Section 21 of the Act, 1993, to bring the fresh assessment within the period of limitation.

6. What was the Gauhati High Court's decision regarding the reassessment? The Gauhati High Court dismissed the writ petition filed by the appellant. It held that the reassessment was within limitation under Section 21 of the Act because sanction was duly granted by the Commissioner on March 21, 2011. The High Court also stated that the quashing of an earlier assessment as time-barred (due to the absence of Commissioner's sanction) did not prevent a fresh assessment from being made after sanction was granted.

7. What did the High Court direct regarding the ex-parte assessment and proper hearing? The High Court directed that the earlier ex-parte assessment should not be acted upon and that a fresh assessment should be made after giving a proper hearing to the Petitioner. The Petitioner was instructed to appear before the Assessing Authority on December 17, 2012, for this purpose.

8. What is Section 19 of the Assam General Sales Tax Act, 1993, about? Section 19 of the Act, 1993, sets out the time limits for completion of assessment and reassessments.

- No assessment under Section 17 shall be made after three years from the end of the assessment year, or two years from the receipt of a return/revised return, whichever is later.

- For cases under sub-section (6) of Section 17, assessment can be made at any time before the expiry of eight years from the end of the year.

- No reassessment under Section 18 shall be made after three years for cases under clause (1), and after one year from the end of the year in which the notice is served for cases under clause (b).

- An assessment, reassessment, or re-computation to give effect to an order in appeal, revision, or reference can be made at any time before the expiry of two years from the end of the year in which the order is communicated to the Assessing Officer.

- The period during which assessment proceedings are stayed by a court or authority is excluded from the limitation period, and proceedings may be completed within one year from the end of the year the stay was vacated.

9. What is Section 21 of the Assam General Sales Tax Act, 1993, about? Section 21 deals with Assessment in certain cases. It states that if no assessment has been made under any of the foregoing provisions within the time limits specified in Section 19, then, notwithstanding anything contained in Section 19, the assessment shall be made within four years from the date of expiry of the limitation period, provided there is prior sanction from the Commissioner. The Commissioner's power to accord such sanction cannot be delegated.

10. What was the "short point" for consideration before the Supreme Court? The Supreme Court considered whether the High Court was correct in its view that even if earlier assessments were time-barred under Section 19, the revenue could obtain appropriate sanction from the Commissioner, and then the limitation would be governed by Section 21 of the Act, 1993.

11. How did the Supreme Court interpret Section 21 in relation to Section 19? The Supreme Court stated that a plain reading of Section 21 indicates it applies only in cases where no assessment has been made under any of the provisions within the time limits specified in Section 19. The Court held that in a case where assessments were already held to be invalid because of being time-barred under Section 19, the revenue could not subsequently take recourse to Section 21 by obtaining Commissioner's sanction to permit reassessment within four years. The Supreme Court found the High Court's interpretation of the two provisions to be "completely incorrect".

12. What principle did the Supreme Court emphasize for construing fiscal statutes? The Supreme Court emphasized that in construing fiscal statutes and determining a subject's tax liability, one must have regard to the strict letter of law. If the case falls strictly within the law's provisions, the subject can be taxed. However, if the case is not covered within the "four corners of the provisions of the taxing statute," no tax can be imposed by inference, analogy, or by probing into legislative intentions.

13. What was the Supreme Court's final decision in these appeals? The Supreme Court allowed the present appeal and the two connected appeals, setting aside the common judgment and order passed by the High Court. The appeals were allowed in terms of the signed order.