V. Pathmavathi v. Bharathi AXA General Insurance Co. Ltd. 2026 INSC 131 -Motor Accident Compensation- Loss Of Love & Affection - Consortium

Motor Accident Compensation - The non-pecuniary loss arising from deprivation of love and affection is comprehended within the broader head of “consortium”. Consequently, no separate award under the head of loss of love and affection is warranted. [But opined: The head of “future prospects” itself is a creation of judicial interpretation, evolved to respond to socioeconomic realities and the legitimate expectations of dependents. If the law is capable of recognising anticipated economic progression as a valid loss, it is not too clear why emotional deprivation manifested in loss of love and affection must be viewed as an impermissible head]

Motor Accident Compensation -The concept of future prospects is an integral component of “just compensation” and is not confined only to those in permanent government employment. Where the deceased was self-employed or on a fixed salary and below the age of 40 years, an addition of 40% of the established income towards future prospects is compulsory. (Para 18)

Motor Accident Compensation - The amount of compensation should be “just”, i.e., it implies that the determination is fair, reasonable and equitable by accepted legal standards and is not a bonanza. Though “just” compensation can never be prefect or absolute compensation, since loss of human life can never be compensated by monetary terms, the principle of awarding “just” compensation and assessing the extent of dependency would depend on examination of the unique situation of each individual case. The determination of income must be founded on proof placed on record and cannot rest on conjecture or assumptions divorced from evidence. (Para 12-16)

Precedents - Judicial discipline demands that a Constitution Bench decision must prevail over a judgment of a Bench of lesser strength. (Para 23)

Quotes - The law must remain responsive to lived human realities, especially in cases involving the sudden rupture of familial bonds. (Para 26)

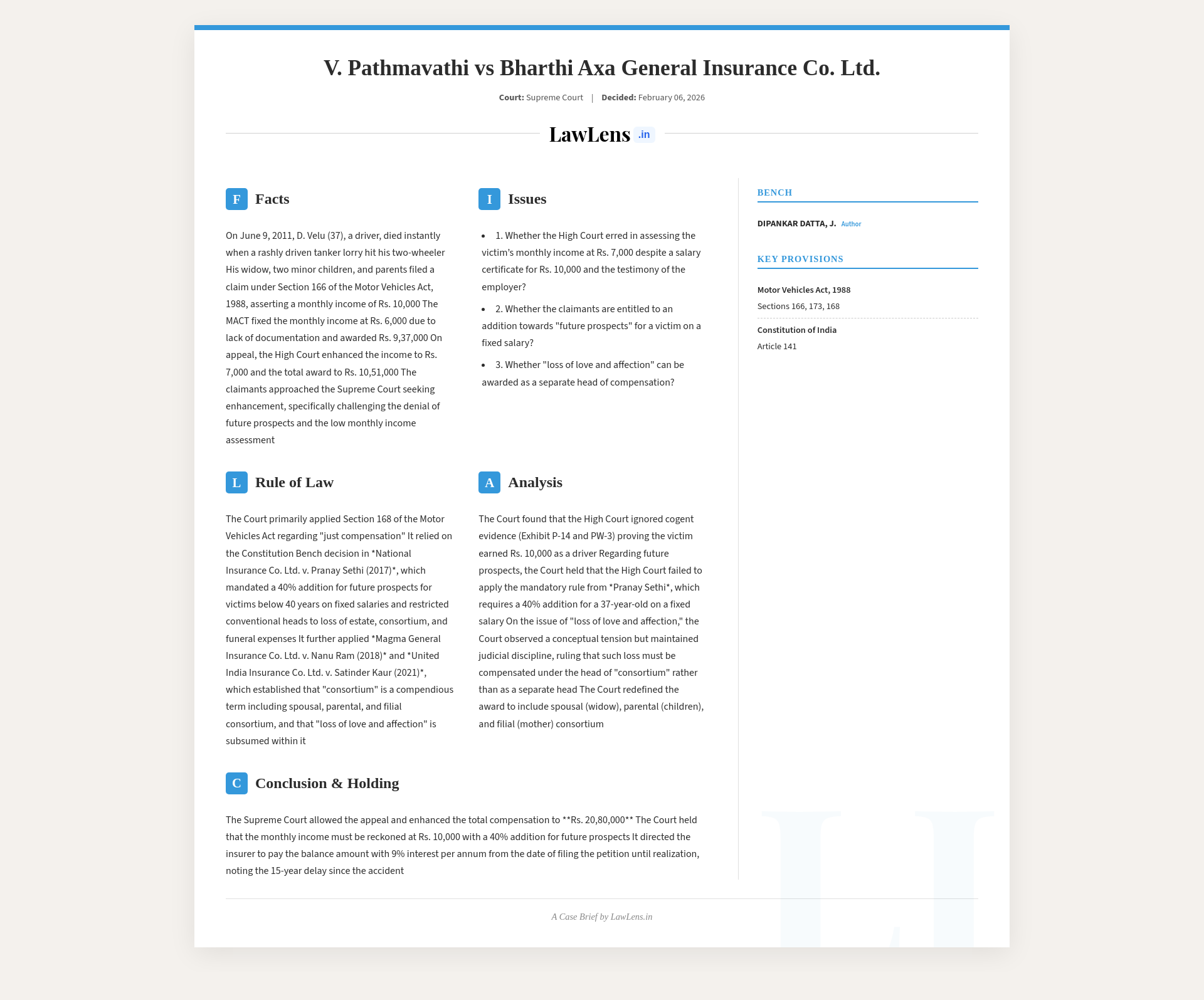

Case Info

Basic Details

Case name: V. Pathmavathi & Ors. v. Bharathi AXA General Insurance Co. Ltd. & Anr.

Neutral citation: 2026 INSC 131

Coram:Justice Dipankar DattaJustice Satish Chandra Sharma

Judgment date: 06 February 2026 (New Delhi)

Statutes / Laws Referred

Motor Vehicles Act, 1988:

- Section 166

- Section 168

- Section 173

Constitution of India:

- Article 141 (binding nature of Supreme Court precedents)

Case Laws and Citations Referred

- National Insurance Co. Ltd. v. Pranay Sethi, (2017) 16 SCC 680

- Sarla Verma v. DTC, (2009) 6 SCC 121

- Santosh Devi v. National Insurance Co. Ltd., (2012) 6 SCC 421

- Rajesh v. Rajbir, (2013) 9 SCC 54

- Reshma Kumari v. Madan Mohan, (2013) 9 SCC 65

- Magma General Insurance Co. Ltd. v. Nanu Ram, (2018) 18 SCC 130

- United India Insurance Co. Ltd. v. Satinder Kaur, (2021) 11 SCC 780

- Various High Court decisions mentioned illustratively in Magma (e.g., Jagmala Ram, Rita Rana, Lakshman) – not central ratios here.

Three‑Sentence Brief Summary

The Supreme Court enhanced the compensation payable to the dependants of a driver who died in a 2011 motor accident, fixing his proven monthly income at Rs. 10,000, adding 40% towards future prospects as mandated by Pranay Sethi, and recalculating loss of dependency with the appropriate multiplier. It harmonised the law on non‑pecuniary heads by holding that separate compensation for “loss of love and affection” cannot be granted, as such emotional loss is now subsumed within the broader head of consortium (spousal, parental and filial), and awarded consortium accordingly while disallowing a distinct “love and affection” head. Overall compensation was increased to Rs. 20,80,000 with interest at 9% per annum from the date of claim, recognising the long delay of about 15 years in the dependants securing just compensation.